State government’s consultation announcement

We understand the announcement of the consultation period to expand the scope of the Container Deposit Scheme may have raised questions.

Please note, this announcement does not impact the current scope of eligibility.

You can find out more about what containers are eligible here. If your container is not included in this list of eligible containers, you are not a First Responsible Supplier for this product and therefore do not need to do anything.

It is important to note that the consultation process and outcome are being managed and decided by the State Government. More information regarding the announcement can be found here. If you have any questions about this announcement, please contact [email protected].

What is a First Responsible Supplier?

The First Responsible Supplier (FRS) of a beverage product is outlined in as:

- The person who first supplies the beverage product in the State; or

- The person who, under the regulations, is taken to be the First Responsible Supplier of the beverage product.

The First Responsible Supplier can be:

- Manufacturers within WA who supply to distributors, retailers or consumers within WA;

- Any entity outside of WA that supplies or imports into WA. This may encompass:

- Manufacturers;

- Distributors;

- Wholesalers;

- Importers; and

- Retailers.

First Responsible Suppliers that supply eligible beverage containers into Western Australia will fund the Container deposit scheme. The contribution that each business makes to the scheme will be based on their sales in Western Australia.

New to the Scheme?

If you are a manufacturer, distributor, wholesaler, importer or retailer and supply containers into Western Australia you may be a First Responsible Supplier. Follow the steps below to determine if you need to sign a supply agreement and register your products with WARRRL.

Step 1. Are you an FRS?

Use these links to determine if you are considered a First Responsible Supplier and if your containers are eligible.

Step 2. How to Register?

Register your company details via the registration link. Once your details have been accepted, a supply agreement will be generated for your company directors to sign. Please note all supply agreements are the same and no amendments can be made.

*Please note the State Government’s announcement of the consultation period to expand the scope of the Container Deposit scheme does not impact the current scope of eligibility. You can find out more about what containers are eligible here. If your container is not included in this list of eligible containers, you are not a First Responsible Supplier for this product and therefore should not register these containers.

Step 3. Register your containers and submit sales volumes

Once your agreement is fully signed and you have been issued a Scheme ID, use the link to the B2B Business Portal to login and register the products you are supplying into WA. You will also need to submit 12 months of your historical sales volumes.

You can check your product registration by using the eligibility checker on the Containers for Change website.

WA Supplier Obligations

As a First Responsible Supplier into WA you have obligations to ensure you are compliant with the scheme, please note:

- Sign a supply agreement with WARRRL

- Provide your historical sales volumes for the past 12 months

- Register all of your eligible containers that are being supplied into WA on the business portal and ensure this information is kept up to date and accurate

- Ensure all eligible containers have a 10c refund mark as of 1 October 2022

- Submit your sales volumes each month via the business portal

- Provide an annual Statutory Declaration at the end of each financial year confirming your sales volumes

- Upon receiving your invoice, make payment within the timeframe on the invoice and pay additional interest if payment is overdue

- If you are no longer supplying eligible containers into WA or are no longer a First Responsible Supplier, due to sale or closure of your business, provide 20 business days notice to WARRRL and ensure your company director signs a statutory declaration to confirm this.

Pricing Guide

The amount a First Responsible Supplier (FRS) contributes is based on the number of products each FRS supplies into Western Australia.

Contribution required from First Responsible Suppliers from 1 February 2023

| Material Type | Cost per container supplied (ex GST) |

Plus GST | Cost per container supplied (Inc GST) |

| Aluminium | 12.39 cents | 1.24 cents | 13.63 cents |

| Glass | 12.84 cents | 1.28 cents | 14.12 cents |

| HDPE | 12.85 cents | 1.29 cents | 14.14 cents |

| PET | 12.76 cents | 1.28 cents | 14.04 cents |

| LPB | 13.17 cents | 1.32 cents | 14.39 cents |

| Other materials | 13.17 cents | 1.32 cents | 14.39 cents |

| Weighted average cost | 12.66 cents | 1.27 cents | 13.93 cents |

Please note:

- The Supply Amount Calculation Methodology used for scheme pricing calculations can be found here.

Resources

Are you also an Exporter?

In some circumstances, beverage products manufactured or first sold into Western Australia will be exported out of the State — either overseas, or to another Australian state or territory.

Because these containers do not stay in Western Australia for consumption or redemption, they are not a cost to the scheme. The exporter of these containers is therefore eligible for an export refund.

A company that exports beverage products in eligible containers can claim the export refund if the containers have had the scheme costs paid, and there is an exporter rebate agreement with WARRRL in effect.

The exporter rebate agreement provides a direct contractual relationship between the exporter and WARRRL, allowing WARRRL to audit and verify the export refund claim.

To create an exporter rebate agreement please complete the following spreadsheet and send it to [email protected].

FAQ

Pricing

Will the cost to First Responsible Suppliers change over time?

- It is expected that the costs of running the scheme will change over time as the scheme becomes established and more customers take up the opportunity to return their eligible containers and receive a refund.

- WARRRL will aim to set the scheme prices in advance for each six-month period to assist beverage suppliers with budget planning requirements.

Why is the cost per container more than the 10c refund?

- First Responsible Suppliers are only charged for their share of the overall costs of the scheme. This includes the cost of refund amounts paid for containers redeemed, plus operational costs of running the scheme (such as refund point handling fees, logistics and processing costs, and other overheads of WARRRL). WARRRL does not derive any profit from operating the scheme, as it is a registered not-for-profit entity.

- The exact formula used to determine this charge can be found here.

Invoicing

I’ve received an estimate on my invoice which isn’t correct, how can I change this?

- An estimate is generated by the system if you have not submitted your sales volumes by the 15th of the following month (or the nearest business day if the 15th falls on a weekend/public holiday). You can login to the portal and submit your volumes and any debits/credits from the estimate will be reflected in your next invoice.

I need to change my sales volumes from over 12 months ago but they are locked on the portal, what do I do?

- Please send your request to [email protected]. The team can update your previous sales volumes on your behalf. Please note you may have to provide an updated statutory declaration for the relevant financial year to reflect the updated volumes.

Can I be invoiced quarterly?

- If you are considered a ‘minor beverage supplier’ i.e. you are selling less than 300,000 beverage products in a financial year you can request to be invoiced quarterly. Please email [email protected] to request this.

I submitted my sales volumes but when my invoice was sent out I realised I made a mistake, how do I update this?

- If you have submitted incorrect sales volumes by mistake please make your adjustments on the portal. Detailed instructions on how to do this are located here.

- Please note your adjustments will be reflected in your next invoice after they have been approved by the auditor, the cut off date for sales volumes submissions and adjustments is the 15th of each month. If you submit your updated volumes after this date the adjustment will be reflected in the following months invoice.

I entered in my sales volumes but my invoice is showing a different amount to what I entered

- The cut off for sales volume submissions is the 15th of the following month. For example if you are submitting volumes for February you need to enter them in by the 15th of March. If you don’t submit on time the system will generate an estimate based on previously submitted sales volumes. You can still submit your sales volumes via the portal and any debits/credits from the estimate will be reflected in your following invoice.

WARRRL

Who is responsible for operating the Container Deposit Scheme?

- The Western Australian Government appointed WA Return Recycle Renew Limited (WARRRL) to establish and operate Western Australia’s container deposit scheme.

- WARRRL is a registered not-for-profit (NFP) organisation and is committed to establishing an effective, convenient, accessible and low-cost container deposit scheme for Western Australia; ensuring consumers can collect a 10c refund for each eligible container and that the scheme provides significant benefits through reduced beverage container litter, increased recycling rates and opportunities for community participation and involvement.

FRS

How do I enter into a supply agreement and register my containers?

- Please use the step by step instructions here to register for your supply agreement. Once your supply agreement is fully signed by your company and WARRRL, you will be able to access the portal to register your products and submit historical sales volumes.

If we manufacture a beverage product in WA and then sell to an organisation in a state that doesn’t have a container deposit scheme, do we still pay for the scheme in Western Australia?

- No, you will not be subject to the scheme’s costs in Western Australia. If your beverage product is not sold to a party in Western Australia no Western Australia container deposit scheme costs are payable, assuming your containers move from the manufacturing warehouse in WA to the customer’s warehouse in the non-container deposit scheme State.

We are already being charged a CDS levy by a manufacturer, do we still need to pay WARRRL invoices?

- If you are considered a First Responsible Supplier and you are supplying eligible beverage containers into Western Australia you are required to make payments towards the scheme. If you are also being charged a CDS levy by a beverage manufacturer you will need to liaise with them to ensure you are not paying more than you are required.

Can I opt out of the scheme?

- No, you cannot opt out. If you are deemed the First Responsible Supplier and are suppling eligible containers into WA you are required by law to sign a supply agreement with WARRRL and contribute to the scheme.

- It is an offence to sell an eligible container in Western Australia without entering into an agreement with WARRRL and registering your eligible containers via the business portal.

We are a re-use business; our customers return our reusable containers to us. Do we need to sign a supply agreement and pay a contribution for our sales volumes?

- Returnable/refillable containers are not eligible containers under the container deposit scheme and are exempt from scheme costs. Refer to regulation 3B.

I have a signed supply agreement with WARRRL and can access the QLD portal but can’t access the WA portal.

- If you have a supply agreement fully signed with WARRRL you should have access. Please contact [email protected] to check this. QLD and WA schemes are run separately so you do not automatically have access to both portals even though the portals are very similar.

Products

What containers are considered eligible in the Scheme?

- The full list of products eligible in the scheme can be found here including examples of containers which are not eligible.

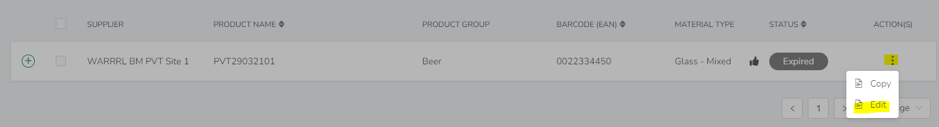

I made a mistake when registering my product, how do I make an amendment?

- You can make amendments to products via the business portal, under the Actions heading click on the ellipses button (3 dots) next to the product you wish to amend and then click on Edit. From here you will be taken to a screen where you can amend the details of your product. Once you are happy with the updated details press submit.

- Once the amendment has been made it will need to go through the same process of approval as a new registration. Your product is still able to be redeemed by customers while it is being approved.

- Please note you will not be able to edit the barcode of your barcode. Each barcode is a unique product identifier so a change in the barcode will mean you need to register a new product.

My product is showing as already registered but I am the First Responsible Supplier, how do I transfer it into my name?

- Email [email protected] with the product barcode and description and we can assist in providing more information for you.

- A list of products were approved under WARRRL’s name prior to the start of the scheme to ensure consumers could redeem as many products as possible. Your product may already be approved under WARRRL’s name, if this is the case we can arrange for it to be transferred back into your name.

My product is already approved in the QLD portal but I can’t see it in the WA portal?

- The QLD and WA schemes are completely separate. Each of your products supplied into WA must be registered in the WA portal once your supply agreement is signed.

- There is no transfer of product approvals between QLD and WA even though the portals look very similar.

What is my products registration number?

- The WA scheme doesn’t use registration numbers for products, each product is identified by its barcode.

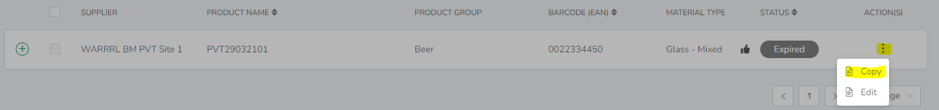

I entered my barcode incorrectly in the portal, how do I update this?

- Each barcode is a unique product identifier so a change in the barcode will mean you need to register a new product.

- To do this log into the business portal, click on the ellipses button (3 dots) next to the product you wish to change the barcode of and then click on Copy. This will copy over the information of your product with the incorrect barcode. Then you can enter in the correct barcode and click on submit.

- Please email [email protected] to request the incorrect product barcode be removed from the system.

I am no longer the First Responsible Supplier for a product registered under my name, how do I remove it?

- If the product will no longer be supplied into WA, for example if the product is being discontinued, please get in touch with [email protected] to request the product be removed from the portal. Please note if the product is removed and then you decide to start supplying it into WA again you will need to re-register your product as if it was a new product.

- If you are no longer the First Responsible Supplier but the product will still be supplied into WA. Please complete the attached transfer form and send through the details of the new First Responsible Supplier to [email protected].

How long does it take for a container to be fully approved?

- The whole approval process can take up to 35 business days or 7 weeks (assuming no further information is required) however the product is usually approved earlier than this. This process cannot be escalated in any way.

- It’s recommended that you register your product on the portal as early as possible to ensure it is approved in time for release.

Exporters

What is an export rebate?

- An export rebate is a refund on the contribution the beverage manufacturer has paid on eligible beverage containers sold or supplied in Western Australia that are then exported to another state or overseas.

What are my obligations as an exporter?

- Each month you export products from WA you will need to submit the volumes you exported through the business portal (referred to as an export sale statement) including what state the products were exported to and who was the First Responsible Supplier of these products. If you need to adjust your previously submitted volumes please follow the instructions outlined in the user guide.

- You also need to sign a statutory declaration at the end of each financial year confirming your previously submitted volumes.

When will my refund be paid?

- WARRRL will pay exporters by the 15th of the following month if the export sale statement has been submitted on time.

- For example, if the export sale statement was provided between:

- 16 May 2021 and 14 June 2021 inclusive:

- the invoice will be prepared on 1 July 2021 (the first Business Day of July) and

- paid by 15 July 2021.

- 15 June 2021 and 15 July 2021 inclusive:

- the invoice will be prepared on 1 August 2021 and

- paid by 15 August 2021

- 16 May 2021 and 14 June 2021 inclusive:

Who can claim the export rebate?

- A company that exports beverage products in eligible containers can claim the export rebate if the containers have had the scheme costs paid, and there is an export rebate agreement with WARRRL in effect.

When is the deadline for submitting export sale statements?

- The lodgement deadline for export sale statements is the 15th day (or nearest business day) of the following month. For example, to claim exports made in March 2021 the deadline is Friday 14th of May 2021, being the nearest Business Day to the 15th of the month two months after the operating month.

Contact Us

If your question or query is related to the consultation period for the container deposit scheme, you can find out more here. If you have any questions about this announcement, please contact [email protected].

Contact Centre

For requests to register as a First Responsible Supplier (FRS) and any technical issues relating to the portal (accessing or registering your products) please get in touch with the contact centre at:

Email: [email protected]

Ph: 13 42 42

The contact centre opening hours are:

Mon – Fri 8am- 5pm (AWST)

Sat 9am – 2pm (AWST)

Sun CLOSED

WARRRL Commercial

For all queries relating to your supply agreement or export rebate agreement, your obligations as an FRS or Exporter, changes to your company information or requesting portal access please contact our Commercial team at:

Email: [email protected]